marin county property tax calculator

Marin County collects the highest property tax in California. 415 499 7215 Phone 415 499 6542 Fax The Marin County Tax Assessors Office is located in San.

Marin Library System Seeks Parcel Tax Hike Amid Rising Costs

Tax Rate Book 2019-2020.

. This Homestead Portability Calculator dollar and tax estimates are based on the following assumptions and mathematical assumptions. For comparison the median home value in Marion. Tax Rate Book 2020-2021.

The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate. Pay online or by phone by 1159 pm. This tax estimator assumes the referenced.

Marin County tax office and their website have the rules procedures. The property tax rate in the county is 078. 3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608.

Tax Rate Book 2017-2018. Mina Martinovich Department of Finance. The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county.

The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of. By Your Assessor Parcel Number APN Enter the APN from your tax bill in the box below to search for the parcel taxes specific to your parcel number for which you are not already taking. While the exact property tax rate you will pay for your properties is set by the local tax.

Tax Rate Book 2018-2019. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Tax Rate Book 2021-2022.

The Marin County Tax Collector offers electronic payment of property taxes by phone. On Monday April 11 2022. 3501 Civic Center Drive Suite 208.

This service has been provided to allow easy access and a visual display of county property tax information. Martin County Property Appraiser. All reasonable effort has been made to ensure the accuracy of the data provided.

San Rafael California 94903. Our Marion County Property Tax Calculatorcan estimate your property taxes based on similar properties and show you how your property tax burden compares to. Your actual property tax burden will depend on the details and features of each individual property.

Real Property Searches. For comparison the median home value in Marin. Property Tax Payments Mina Martinovich Department of Finance Telephone Payments.

The supplemental tax bill is in addition to. Marin County is responsible for assessing the tax value of your property and that is where you will register your appeal. You can use the California property tax map to the left to compare Marin Countys property tax to other counties in California.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

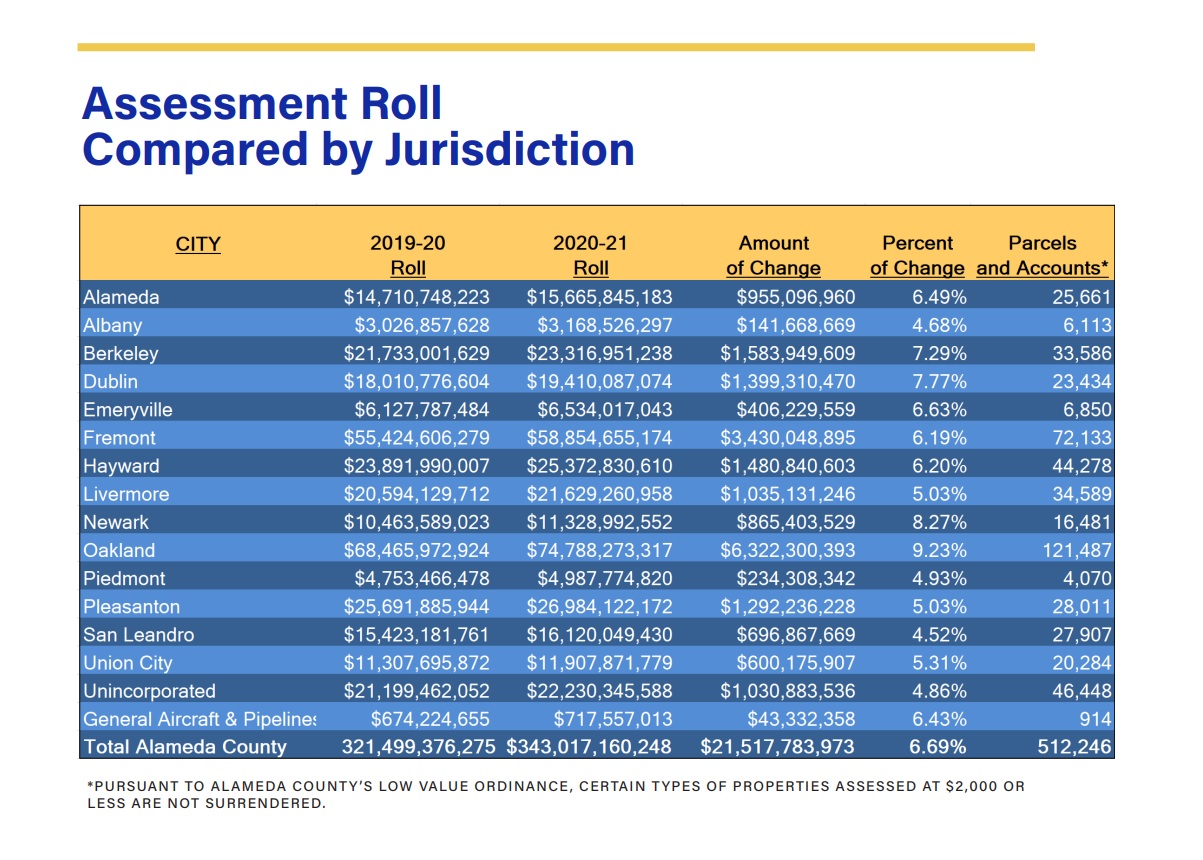

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Property Tax How To Calculate Local Considerations

Assessor Recorder County Clerk Marin County

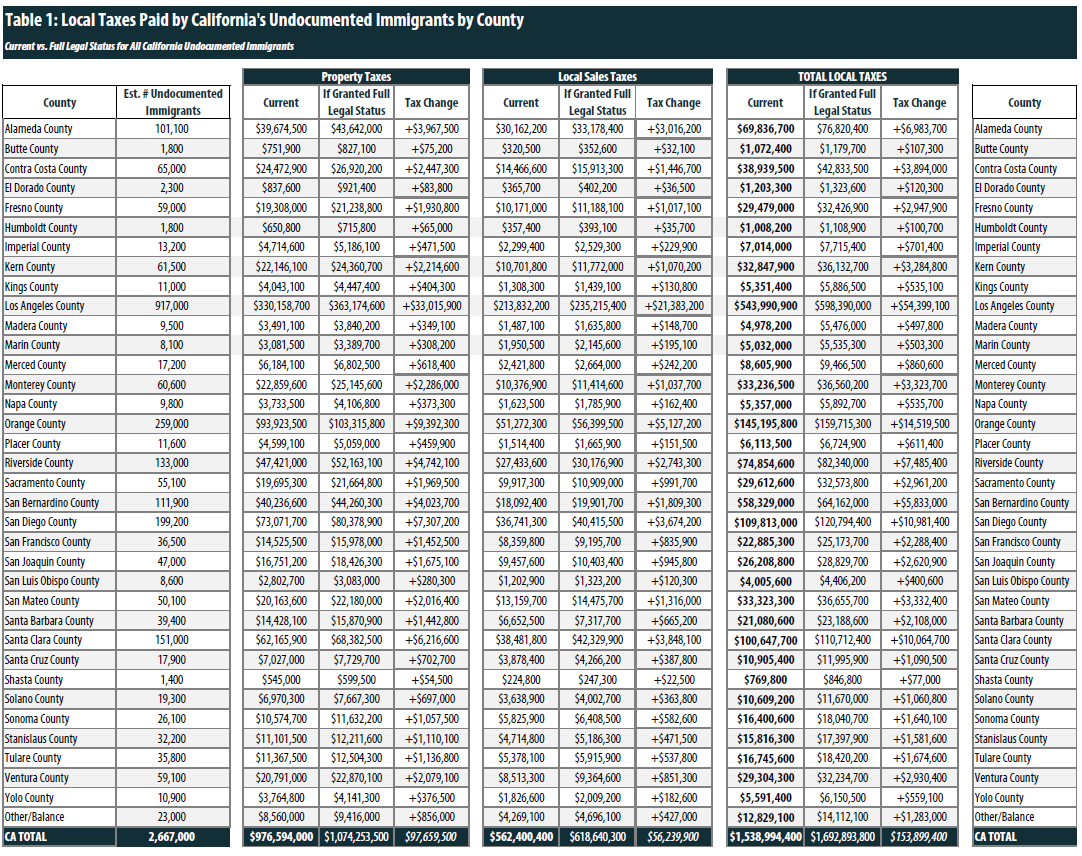

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

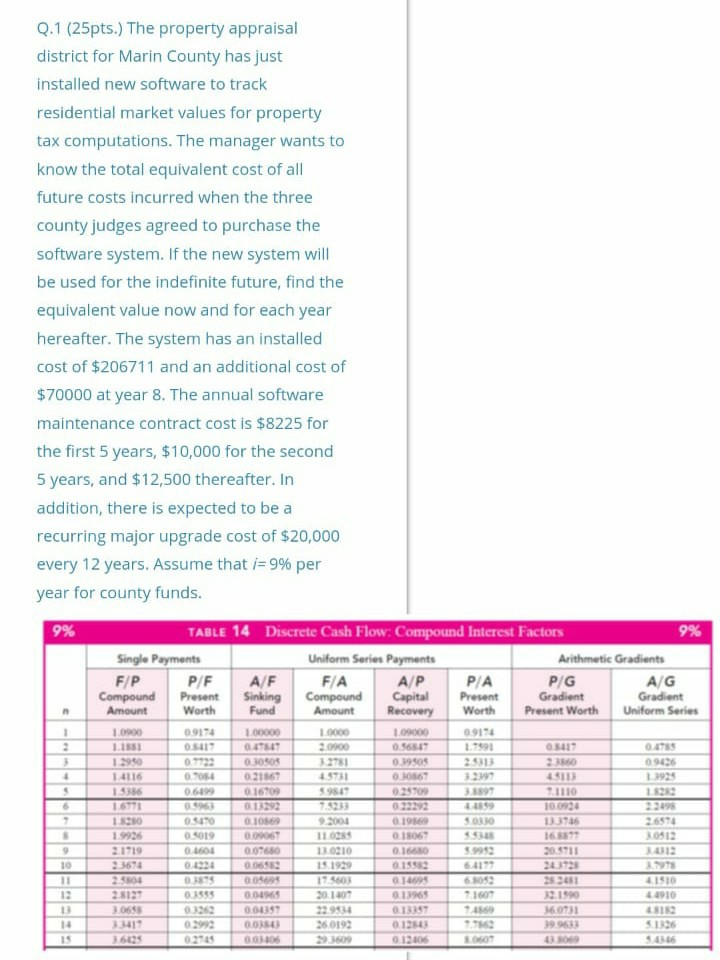

Solved The Property Appraisal District For Marin County Has Chegg Com

The Property Tax Inheritance Exclusion

Understanding California S Property Taxes

High Property Taxes Why You Re Paying So Much Money

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

California Property Tax Calculator Smartasset

What A Living Wage Is And Why Businesses Should Use It As A Benchmark Just Capital

Orange County Ca Property Tax Calculator Smartasset

Marin Wildfire Prevention Authority Measure C Myparceltax

Riverside County Ca Property Tax Search And Records Propertyshark

San Benito County Ca Property Tax Search And Records Propertyshark

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa